Fcf margin meaning

The free cash flow yield is an overall return evaluation ratio of a stock which standardizes the free cash flow per share a company is expected to earn. The more free cash flow a.

Financial Ratios Statement Of Cash Flows Accountingcoach Financial Ratio Cash Flow Statement Financial

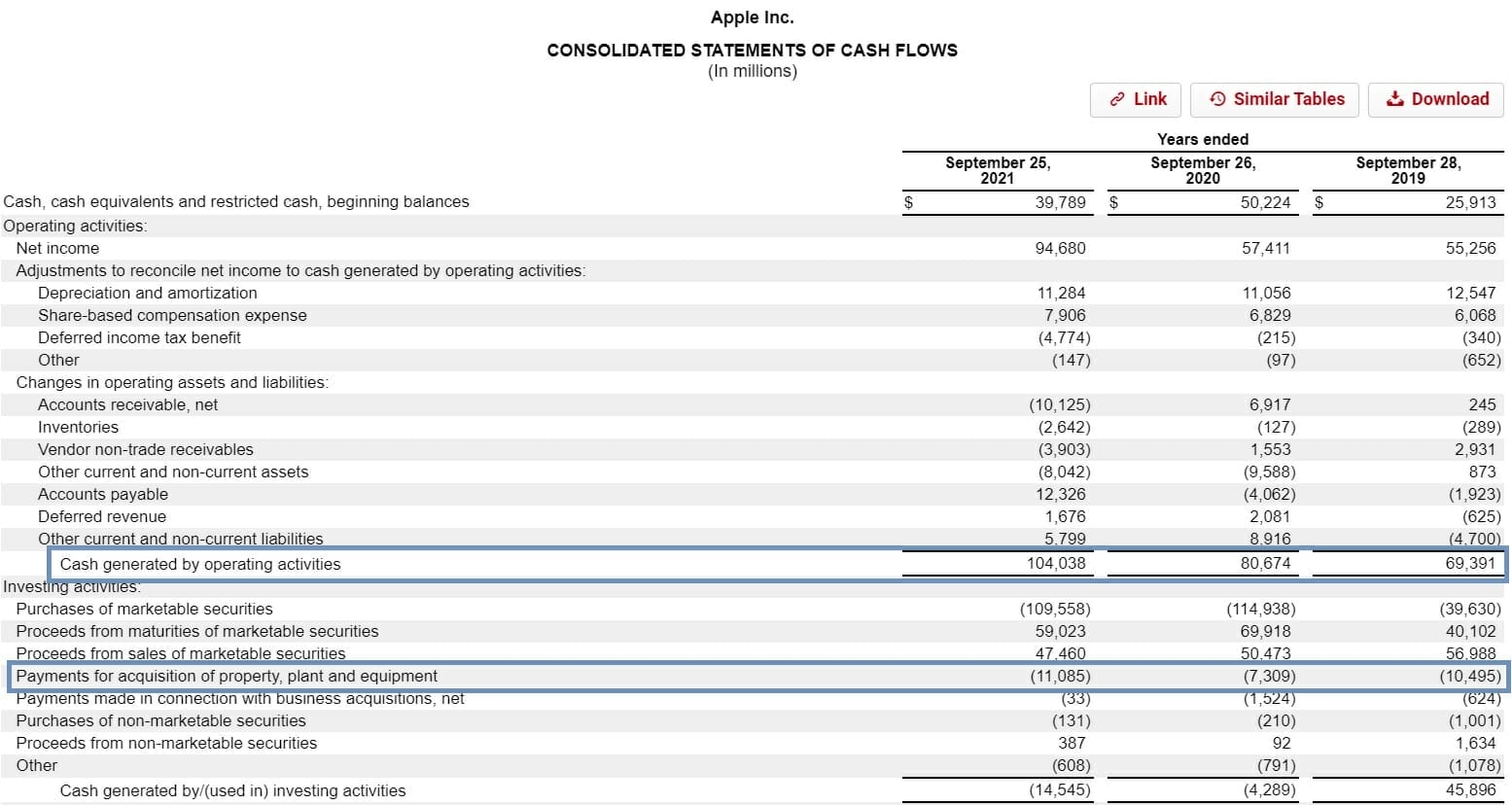

To break it down free cash flow yield is determined first by using a companys cash flow statement subtracting capital expenditures from all cash flow operations.

. An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. The company reported a positive operating cash flow of. Free cash flow FCF is the money a company has left over after paying its operating expenses OpEx and capital expenditures CapEx.

Unlevered Free Cash Flow - UFCF. Define Threshold FCF Margin. NextEra Energy NEE is an American electric utility company with a market capitalization of roughly 163B.

Related to Maximum FCF Margin Applicable LC Margin means the per annum fee from time to time in effect payable with respect to outstanding Letter of Credit Obligations as determined by. In corporate finance free cash flow FCF or free cash flow to firm FCFF is the amount by which a businesss operating cash flow exceeds its working capital needs and expenditures on fixed. The basic definition for FCF is generally.

Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. 925000 during same period We now have the numbers needed to calculate free cash flow margin. Unlevered free cash flow.

Free Cash Flow Yield. Operating Cash Flow Margin. The Balance Small Business Menu Go.

Also called Operating Cash Flow Margin and Margin Ratio the Cash Flow Margin measures how well a companys daily operations can transform sales of. Means the minimum level of FCF Margin that must be achieved in order for any amount to be earned by the Eligible Executive pursuant to an Award Opportunity. FCF Margin means the Companys net cash flow provided by operating activities less capital expenditures for the Performance Period expressed as a percentage of the Company s.

Examples of Free Cash Flow Margin in a sentence. It may take a while. However ultimately a company must show an ability to generate free cash flow contend Mulford and Surani.

FCF Cash from operations capital expenditures. Explanation of Cash Flow Margin. During the 12 months ending September.

A guide to cash flow margin one of the most important profitability ratios and determine how well it converts sales to cash. Based on FY22E Revenue Growth Free Cash Flow Margin guidance of at least 32 in preliminary results released on August 12. Free cash flow margin simply takes the FCF and compares it to a companys.

There Are A Variety Of Business Valuation Methods To Choose From Learn Which One To Use Whe Business Valuation Financial Modeling Business Strategy Management

Free Cash Flow Margin Accounting Ratio Gmt Research

Accounting Ratios Accounting And Finance Bookkeeping Business Small Business Accounting

Financial Ratios And Formulas For Analysis Financial Ratio Financial Analysis Financial Accounting

:max_bytes(150000):strip_icc():gifv()/Term-Definitions_freecashflow_FINAL-ebecf2a8576047c0a8b9446f29b63b71.png)

Free Cash Flow Fcf Formula To Calculate And Interpret It

/operatingmargin2-0ea7e3aeb5e5473bb2f5a174217c4396.png)

Operating Margin What It Is And The Formula For Calculating It With Examples

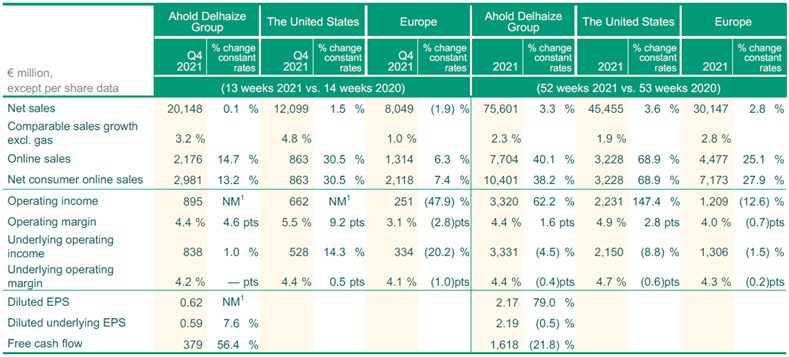

Ahold Delhaize Ends 2021 With Accelerating Q4 Sales 2022 Outlook Forecasts Solid Margins And Continued Strong Free Cash Flow Generation

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Financial Ratios And Formulas For Analysis Financial Ratio Financial Analysis Accounting Education

Profit Margin Formula And Ratio Calculator Excel Template

Fcf Margin Jm Finn

Defining A Good Fcf Margin Formula Basics Examples And Analysis

Ahold Delhaize Ends 2021 With Accelerating Q4 Sales 2022 Outlook Forecasts Solid Margins And Continued Strong Free Cash Flow Generation

Mizvjx2w2abqnm

Mizvjx2w2abqnm

Defining A Good Fcf Margin Formula Basics Examples And Analysis

Pin On Comparisons